Why Choose Griffin Law?

Thanks to Griffin Law’s proactive and rigorous approach to debt recovery, we will help you keep your business afloat in these difficult times. Griffin Law will research key financial information, investigate evidence of the debtor’s assets and advise you quickly if it is commercially viable to take action.

We have the expertise to support your business in the pursuit of your debts, starting with a solicitor’s “letter before action” all the way through to judgment at court. We don’t give up, or take no for an answer.

Griffin Law has built long-lasting relationships with clients, providing quick and effective support at all times. We understand what your business needs, which is crucial to providing effective legal support, giving you the confidence to focus on growing your business.

Griffin Law guarantees to share the risk of litigation through working under success-based and fixed fee agreements. Our costs are transparent and we will only be entitled to our full fee after a successful result. We are lawyers who not only understand the commercial world; we talk in the same language as well.

Dealing with debt and contractual recovery

Debt can destroy your business if not avoided or managed

Debt can destroy your business if not avoided or managed. Implementing ways to prevent or, if prevention is not possible, recover debts quickly and cost-efficiently, is crucial for the effective management of your business. Mindful that many of your customers or clients may be reluctant to pay you for goods or services rendered, thereby affecting your cash flow and jeopardising your livelihood, Griffin Law will work with you to salvage business relationships where they can be salvaged and to secure the fastest and most cost-effective recovery of money owed to you – whether it be by way of litigation, the use of bankruptcy and corporate insolvency proceedings or via an out-of-court settlement. We can also consider if the Directors of those companies who owe you money can be personally liable to repay it if fraud was involved. Business owners are rarely equipped with the time or knowledge of the law to pursue debtors, causing distraction and wasted costs. Debt collection agencies rarely offer value for money and make promises that all too often prove optimistic to say the least.

Debt can destroy your business if not avoided or managed. Implementing ways to prevent or, if prevention is not possible, recover debts quickly and cost-efficiently, is crucial for the effective management of your business.

Mindful that many of your customers or clients may be reluctant to pay you for goods or services rendered, thereby affecting your cash flow and jeopardising your livelihood, Griffin Law will work with you to salvage business relationships where they can be salvaged and to secure the fastest and most cost-effective recovery of money owed to you – whether it be by way of litigation, the use of bankruptcy and corporate insolvency proceedings or via an out-of-court settlement. We can also consider if the Directors of those companies who owe you money can be personally liable to repay it if fraud was involved.

Business owners are rarely equipped with the time or knowledge of the law to pursue debtors, causing distraction and wasted costs. Debt collection agencies rarely offer value for money and make promises that all too often prove optimistic to say the least.

Thanks to Griffin Law’s proactive and rigorous approach to debt recovery, we will help you keep your business afloat in these difficult times. Griffin Law will research key financial information, investigate evidence of the debtor’s assets and advise you quickly if it is commercially viable to take action.

We have the expertise to support your business in the pursuit of your debts, starting with a solicitor’s “letter before action” all the way through to judgment at court. We don’t give up, or take no for an answer.

Griffin Law has built long-lasting relationships with clients, providing quick and effective support at all times. We understand what your business needs, which is crucial to providing effective legal support, giving you the confidence to focus on growing your business.

Griffin Law guarantees to share the risk of litigation through working under success-based and fixed fee agreements. Our costs are transparent and we will only be entitled to our full fee after a successful result. We are lawyers who not only understand the commercial world; we talk in the same language as well.

Our team of experienced lawyers can help:

- identify the risks and approach to the recovery of a debt at an early stage;

- assess the legal costs involved in pursuing a debt;

- establish your prospects of success;

- assess the risk of not succeeding and the costs involved;

- calculate the necessary time and resources required from you to pursue a debt;

- determine whether a commercial settlement is appropriate or whether (for business or reputational and policy reasons) you should pursue a matter through to a final hearing;

- prepare a robust response to ensure that your business and its reputation are protected;

- advise whether there are any lessons to be learnt from the process, including identifying any potential training requirements or changes to your policies and procedures that might be required.

How much does debt recovery cost?

Our typical fees for pursuing debtors on behalf of creditors in claims for up to £100,000 are set out below. These fees are based on cases that proceed to a final hearing and are based on our experience of the average time a matter takes to be dealt with and our hourly rates. If a matter concludes earlier, then the fee will be less (e.g. if an out-of-court settlement is agreed).

There are typically three levels of debt recovery claim depending on the complexity and the fee varies accordingly. We have also set out in more detail how we charge and the factors that will affect what the total fee will be for defending a claim. All fees are exclusive of VAT charged at 20%.

- Simple claim – fees range from £10,000 – £20,000 (excluding VAT)

- Medium claim– fees range from £20,000 – £40,000 (excluding VAT)

- Complex claim – fees range from £40,000 – £100,000 (excluding VAT).

There will be an additional charge for attending a hearing of between £1,200 and £2,500 per day (excluding VAT), depending on the hourly rate of the lawyer involved.

The hourly rates charged by our lawyers are as follows:

- Directors, Consultants & specified Senior Associates: £400 per hour (excluding VAT);

- Specified Senior Associates, Associates and legal executives with over 4 years’ equivalent experience: £350 per hour (excluding VAT);

- Associates, Assistants, legal executives and fee-earners with up to 4 years’ equivalent experience: £250 per hour (excluding VAT);

- Trainee Solicitors, Paralegals & Support Staff: £200 per hour (excluding VAT).

Factors affecting the overall fee

While it is impossible to list all the factors that could affect the overall fee, as each case varies, the most common factors to bear in mind are:

- the conduct of the opponent and/or if the debtor is legally represented their lawyers;

- how busy the courts might be with other cases (which could mean that it takes longer for a claim to be heard);

- the location of the court;

- the amount of correspondence and documents for us to review;

- your conduct in working collaboratively with us;

- any preliminary or interim hearings that might be required to determine substantive issues before the final hearing itself;

- postponement of hearings;

- the length of the final hearing itself.

Key stages in the process

The fee ranges set out above will cover all of the work concerning the typical stages of a debt recovery claim. These key stages include:

- taking your initial instructions, reviewing the papers and advising you on merits and likely recovery (this is likely to be revisited throughout the matter and subject to change);

- sending one or more formal letters of claim;

- entering into pre-claim negotiations to explore whether a settlement can be reached;

- preparing your claim;

- reviewing and advising on the debtor’s response to your claim;

- exploring settlement and negotiating settlement throughout the process;

- preparing for and attending a preliminary hearing to resolve any initial issues in relation to the claim;

- reviewing potentially relevant documents and exchanging documents that need to be disclosed with the debtor;

- reviewing the documents disclosed by the debtor;

- preparing witness statements and reviewing/advising on the witness statements provided by the debtor and any witnesses they have called;

- agreeing and preparing the bundle of documents to be used at the final hearing;

- agreeing a list of issues, a chronology and/or cast list.

- preparing for and attending the final hearing, including instructions to the barrister who will represent you at that hearing.

These stages are an indication only. If some of the stages above are not required, the fees would be lower than the estimated fees above, conversely, if there are additional stages, the fee will be at the higher end. You could also reduce the fees by collecting the debt or handling the claim yourself and only having our assistance in relation to some of the stages.

How long does the process take?

The time from taking your initial instructions to the final resolution of a claim depends largely on the stage at which your case is resolved. If a settlement is reached during pre-claim negotiations, or in response to a letter of demand, a claim is likely to take 2 to 6 weeks to conclude.

If a claim proceeds to a final hearing, then typically it will be in the range of 9 to 24 months from when the claim was submitted to the court.

The date for the final hearing is usually set at a preliminary hearing, which generally takes place 3-6 months after the deadline for any formal response to the claim.

Disbursements

Disbursements are costs and expenses related to a claim that are payable to third parties, such as barristers’ fees. As we instruct the barrister on your behalf, we handle the payment of their fees, having first obtained money on account from you.

We will usually recommend that we instruct a barrister to represent you at the final hearing and at any preliminary or interim hearing to determine substantive legal issues.

Barristers’ fees range from £1,000 to £5,000+ per day (excluding VAT), depending on their level of experience and availability. We will only engage the services of a barrister once you have agreed to their fees and remitted funds on account to us to enable us to pay them for you.

Travel expenses will be charged at cost (without any uplift) to you for attending any hearings on your behalf or with you. We may also incur some postage or courier costs, and in complex cases, we may use an e-discovery platform to handle voluminous electronic documentation.

The amount of these expenses will depend on the location of the hearing and the number of times that travel is incurred.

We can help recover your debts with a tailor made service and fee structure. To discuss how the experts in this area can help you, please contact justice@griffin.law or, use our contact form to send us a message.

Related Articles

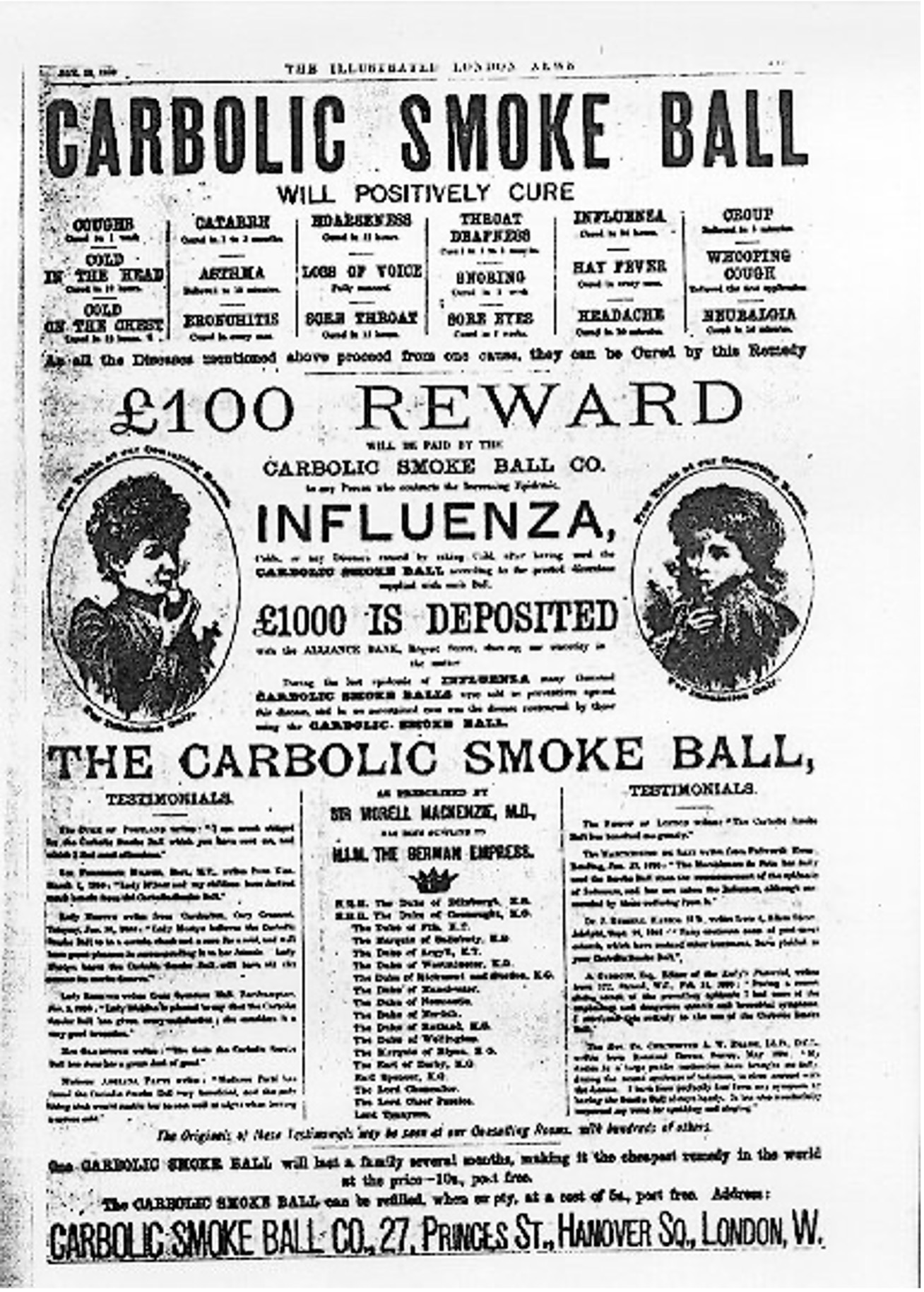

Carlill v Carbolic Smoke Ball Company [1892] EWCA Civ 1

Summary Between 1889 and 1891, the influenza pandemic claimed [...]

Disclosure in bankruptcy – what documents is a trustee in bankruptcy entitled to from a bankrupt’s former solicitor?

'The distinction that is drawn is between the privilege relating [...]

“Virtual” Controlled Goods Agreements (“CGA”)

As many creditors will know, obtaining judgment against a debtor [...]